+968 9596 3381

Phone Number

[email protected]

Email Address

Mon - Thu: 8:00 - 5:00

Online store always open

Phone Number

Email Address

Online store always open

WhatsApp Us Today

Drop Us an Email Today

Google Map Location

Saturday to Thursday

In the dynamic business landscape of Oman, sound financial management is not merely a best practice; it’s a legal imperative and a cornerstone of sustainable growth. Whether you’re a budding startup or an established enterprise, engaging a professional accounting firm is crucial for ensuring compliance with local regulations, optimizing your financial health, and making informed strategic decisions.

Oman’s tax regime, including Corporate Income Tax (CIT), Value Added Tax (VAT), and Withholding Tax (WHT), along with its adherence to International Financial Reporting Standards (IFRS), necessitates expert guidance. Choosing the right accounting partner, however, can be a complex task, given the multitude of firms offering various services.

This comprehensive guide will walk you through the essential steps and key criteria for selecting an accounting firm in Oman that aligns with your business needs. It will highlight why professional accounting is indispensable and how Setup in Oman can facilitate your connection with trusted, licensed accounting experts, ensuring your financial journey in the Sultanate is both compliant and prosperous.

Omani businesses are legally required to maintain proper accounting records, submit tax returns, and ensure compliance with International Financial Reporting Standards (IFRS).

An experienced accounting firm helps you:

Prepare audited and unaudited financial statements

File VAT and corporate tax returns accurately

Avoid penalties from late or incorrect tax submissions

Get advisory on business performance and cost efficiency

Ensure proper internal controls and financial hygiene

You’ll need an accounting firm in Oman if:

You’re launching a new company or startup and need help with financial setup

Your business crosses the VAT registration threshold (OMR 38,500 annually)

You’re required to file audited financials by investors or regulatory bodies

You operate in regulated industries (e.g., finance, construction, health)

You’re applying for tenders or contracts where financial statements are mandatory

Even small businesses benefit from outsourced bookkeeping to avoid hiring full-time staff.

Most accounting firms in Oman provide a mix of essential and value-added services, such as:

Bookkeeping and general ledger maintenance

VAT registration and VAT filing

Corporate income tax (CIT) computation and filing

Payroll processing and labor fund compliance

Budgeting, forecasting, and cash flow analysis

Internal auditing and risk assessments

IFRS-based financial statement preparation

Advisory on cost optimization, M&A, or restructuring

Oman enforces strict tax and accounting regulations:

VAT laws (as per Royal Decree 121/2020)

Corporate Income Tax laws (Royal Decree 28/2009)

Withholding Tax compliance for cross-border payments

Electronic tax filing via OTA’s Tax Portal

A non-compliant business can face:

Fines for incorrect or late filings

Suspension of Commercial Registration

Audits and blacklisting from future tenders

Hiring a qualified accounting firm minimizes these risks and keeps your business in good standing.

Here’s how to evaluate and select a suitable accounting partner:

Look for firms that specialize in Oman’s VAT, CIT, and WHT regulations, not just general accounting.

Accounting for real estate differs from tech startups or retail. Choose a firm that understands your sector-specific nuances.

Ensure the firm is:

Licensed by MoCIIP

Registered with Oman Tax Authority (for tax filings)

Employs certified accountants (e.g., ACCA, CPA, ICAEW)

Can they provide just bookkeeping, or also offer VAT consulting, audits, and financial planning? Choose a one-stop firm if possible.

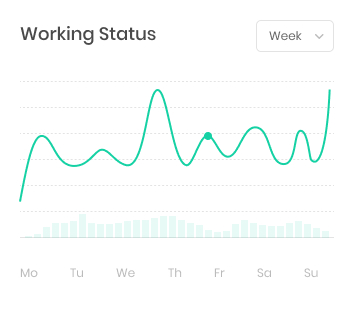

Modern accounting firms in Oman use cloud accounting platforms like Zoho, QuickBooks, or Xero—giving you real-time insights.

Check online reviews, case studies, and ask for references. A reputable firm will showcase past success with similar clients.

✅ Better understanding of local compliance and procedures

✅ Personalized service and affordability

🚫 May lack access to global resources

✅ Global expertise and resources

✅ Ideal for large or multinational businesses

🚫 Higher costs and less tailored for SMEs

For SMEs and startups in Oman, a licensed local firm with regional tax expertise is often the best choice.

How many years of experience do you have in Oman?

What accounting software do you use or recommend?

Can you assist with VAT registration and ongoing compliance?

Will I have a dedicated accountant or team?

What is your pricing model—fixed monthly fee or hourly rates?

Do you handle corporate tax filings directly via OTA’s portal?

The answers will help you gauge transparency, tech adoption, and service compatibility.

Avoid firms that:

Promise “guaranteed tax refunds” or manipulate expenses

Don’t provide engagement letters or service contracts

Aren’t registered with the tax authority

Outsource your work to unknown third parties

Delay response times or lack clarity in deliverables

These issues could jeopardize your financial standing and tax compliance.

Pricing depends on the complexity and scale of your business. General ranges:

Basic bookkeeping: OMR 50 – 150/month

VAT return filing: OMR 100 – 300/quarter

Tax advisory: OMR 200 – 500+

Audit services: OMR 1,000 – 5,000+ (based on company size)

Always request a quote after a business assessment, and ensure the scope of work is defined in writing.

If you’re unsatisfied with your current accountant:

Request a handover file with financials, ledgers, and VAT records

Ensure you retrieve credentials to tax portals and accounting software

Have your new accountant review past filings for accuracy

Notify MoCIIP and OTA if required (for authorized representative changes)

Switching firms requires careful planning to avoid service gaps during tax periods.

Operating a business in Oman comes with specific financial and legal obligations. A professional accounting firm plays a vital role in ensuring your company:

Maintains Legal Compliance: Adheres to the Omani Commercial Companies Law, Income Tax Law, VAT Law, and any other relevant financial regulations.

Ensures Accurate Financial Reporting: Prepares financial statements that comply with International Financial Reporting Standards (IFRS), which is mandatory for most Omani companies, ensuring transparency and credibility.

Navigates Tax Obligations: Manages complex tax registrations, calculations, and timely filings for Corporate Income Tax, Value Added Tax, and Withholding Tax, helping you avoid penalties for non-compliance.

Supports Strategic Decision-Making: Provides insightful financial analysis, budgeting, and forecasting, enabling you to make informed business decisions.

Builds Investor Confidence: Presents well-prepared, audited (if required) financial records that instill trust in investors, creditors, and other stakeholders.

Avoids Penalties: Proactively manages compliance deadlines and accurate reporting, significantly reducing the risk of fines and legal issues from the Oman Tax Authority (OTA) or other regulators.

Reputable accounting firms in Oman typically offer a broad spectrum of services tailored to diverse business needs:

Bookkeeping and Record-Keeping: Daily recording of financial transactions, maintenance of ledgers, and systematic organization of financial documents.

Preparation of Financial Statements: Creation of balance sheets, income statements, cash flow statements, and statements of changes in equity, all in compliance with IFRS.

Tax Compliance & Advisory:

Assistance with CIT, VAT, and WHT registration.

Preparation and timely filing of tax returns.

Tax planning and advisory to optimize tax positions legally.

Handling tax assessments and inquiries from the Oman Tax Authority (OTA).

Payroll Services: Management of employee salaries, wages, benefits, and statutory deductions, ensuring compliance with Omani Labour Law and social security regulations.

Management Accounting & Financial Advisory: Providing internal financial reports, budgeting, forecasting, cost analysis, and strategic financial advice to management.

Audit Preparation & Liaison: Assisting in preparing your books for statutory audits and acting as a liaison with external auditors. (Note: Many accounting firms also have an auditing arm or are part of larger audit groups).

Company Liquidation Support: Assistance with financial closure and liquidation procedures.

Due Diligence: Financial investigations for mergers, acquisitions, or investments.

Feasibility Studies: Financial modeling and analysis for new projects or business ventures.

Selecting the right accounting partner is a critical decision. Here are the key criteria to consider:

Mandatory Licensing: Ensure the firm is properly licensed by the Ministry of Commerce, Industry, and Investment Promotion (MoCIIP).

Audit Licensing (if applicable): If you require statutory audit services, the firm must also be licensed by the Financial Services Authority (FSA) and registered with the Oman Association of Chartered Public Accountants (OACPA). For entities regulated by the Capital Market Authority (CMA) (e.g., publicly listed companies, financial institutions), the audit firm must also have CMA approval.

Professional Body Affiliation: Look for firms whose professionals are members of recognized international bodies (e.g., ACCA, CPA, CA) or local professional associations like the OACPA. This indicates adherence to high ethical and professional standards.

Omani Tax Laws: Paramount importance. The firm must have in-depth, up-to-date knowledge of Oman’s Income Tax Law, VAT Law, and Withholding Tax regulations.

IFRS Compliance: Proficiency in International Financial Reporting Standards is non-negotiable, as IFRS adoption is mandatory for most Omani companies.

Industry Experience: Does the firm have experience working with businesses in your specific industry (e.g., oil & gas, tourism, retail, manufacturing, technology)? Industry-specific knowledge ensures they understand your unique challenges and reporting requirements.

Free Zone Expertise: If your business is located in a Free Zone (e.g., Duqm, Sohar, Salalah), ensure the firm is well-versed in the specific regulations and incentives applicable to Free Zone entities.

Client Testimonials & References: Seek feedback from their current or past clients.

Professional Standing: A firm’s reputation within the Omani business community is a strong indicator of its reliability and quality of service.

Years in Business: While new firms can be excellent, established firms often bring a wealth of experience.

Modern Accounting Software: Inquire about their use of modern accounting software (e.g., QuickBooks, Xero, Zoho Books, SAP, Oracle) and cloud-based solutions. This can significantly improve efficiency, accuracy, and real-time access to your financial data.

Streamlined Processes: Assess their internal processes for data handling, reporting, and communication.

Responsiveness: How quickly do they respond to inquiries? Timely communication is crucial for urgent financial matters.

Clarity in Reporting: Do they provide clear, concise, and understandable financial reports and advice?

Language Capabilities: Ensure they have professionals proficient in both Arabic and English to facilitate smooth communication, especially with government entities and for reviewing legal documents.

Dedicated Point of Contact: Will you have a specific accountant or team assigned to your account?

Transparent Fee Structure: Request a detailed proposal outlining all services included and a clear fee breakdown. Avoid firms with hidden charges.

Value Proposition: Don’t just focus on the lowest price. Consider the overall value, including proactive advice, penalty avoidance, and strategic insights that can save you money in the long run.

Understanding of Local Business Practices: Beyond laws, a good firm understands the nuances of local business culture and administrative procedures.

Follow these steps to choose the best accounting firm for your business in Oman:

Step 1: Define Your Needs: Clearly list the accounting, tax, and advisory services you require. Determine your budget and preferred communication style.

Step 2: Research and Shortlist:

Referrals: Ask for recommendations from other businesses operating in Oman, especially those in your industry.

Professional Bodies: Check the directories of the FSA or OACPA for licensed firms.

Online Research: Use search engines to find firms with good online presence and reviews.

Step 3: Request for Proposal (RFP): Send a clear RFP to your shortlisted firms, detailing your requirements and asking for a comprehensive proposal, including service scope, team credentials, and fee structure.

Step 4: Interview Shortlisted Firms: Schedule meetings (in-person or virtual) with the top candidates. This is your chance to assess their expertise, communication style, client-focused approach, and cultural fit.

Step 5: Check References: Contact their existing clients to inquire about their experience with the firm’s services, responsiveness, and problem-solving abilities.

Step 6: Review Engagement Letter: Thoroughly review the engagement letter. It should clearly define the scope of services, responsibilities of both parties, fee structure, payment terms, and confidentiality clauses.

Step 7: Make Your Decision: Choose the firm that best meets your needs, offers the best value, and instills the most confidence.

At Setup in Oman, we understand that robust accounting and audit services are vital for any business. While we specialize in company formation and PRO services, we act as your trusted partner in connecting you with the right financial experts:

Company Formation: The moment your company is formed in Oman, the need for professional accounting begins. Our Company Formation Services ensure your business is legally established, after which we can seamlessly connect you with reputable, licensed accounting firms in Oman from our trusted network, ensuring your financial records are compliant from day one.

Corporate Bank Account: “Accurate accounting relies on meticulous record-keeping of financial transactions. Our assistance in opening your corporate bank account in Oman ensures you have the necessary financial infrastructure, providing your chosen accounting firm with clear records for their work.

PRO Services: Smooth collaboration between your business and an accounting firm often requires efficient handling of documents and communication with government bodies. Our PRO Services ensure all your company documents are well-maintained and readily available, facilitating the work of your accounting partner in dealing with MoCIIP, the Tax Authority, and other government entities.

Direct Referral to Accounting & Audit Partners: Finding a top-tier, licensed accounting and audit firm in Oman can be challenging. Leveraging our extensive network and local expertise, Setup in Oman acts as a trusted referral partner. We connect our clients with highly reputable and thoroughly vetted accounting and audit firms that align with your specific industry needs and compliance requirements, saving you time and ensuring you partner with the best in the field.

Investor Visa & Work Visa: For the key personnel who will oversee finance and work closely with your accounting firm, obtaining proper residency and work permits is essential. Our Investor Visa and Work Visa services facilitate the smooth legal presence of your management and accounting teams in Oman, enabling effective financial oversight.

Information Asymmetry: It can be difficult to fully assess the quality and suitability of a firm without prior experience.

Cost vs. Value: Balancing budget constraints with the need for high-quality, comprehensive services can be tricky.

Finding Niche Expertise: Locating a firm with highly specialized knowledge in a very specific or emerging industry might require more extensive research.

Choosing the right accounting firm in Oman is a strategic investment in your business’s future. A competent and reliable financial partner not only ensures regulatory compliance but also provides invaluable insights that drive profitability and sustainable growth. By meticulously evaluating potential firms based on their licensing, expertise, reputation, and commitment to client service, you can build a robust financial foundation for your operations in the Sultanate.

Ready to establish your business in Oman and need trusted accounting partners?

Setup in Oman is your gateway to a compliant and prosperous venture. Let us simplify your setup process and connect you with the finest accounting and audit firms in Oman, tailored to your unique business requirements.

Contact Setup in Oman today for a consultation and take the first step towards seamless financial management in Oman.

Contact Setup in Oman today for a consultation and take the first step towards seamless financial management in Oman.

Is it mandatory to hire an accounting firm in Oman?

No, but it is highly recommended, especially for VAT-registered businesses and companies that need to file corporate tax returns.

Can I hire an offshore accountant for my Omani business?

While possible, Omani tax filings must comply with local formats and languages, so local accountants are more practical.

Do accounting firms in Oman file taxes for you?

Yes, most firms offer complete VAT and corporate tax filing services through the OTA portal.

Are annual audits mandatory in Oman?

Only for companies that meet specific thresholds or are regulated by financial bodies or free zone authorities.

Can an accounting firm help with payroll?

Yes, many provide payroll processing, WPS compliance, and employee tax records management.

Fill out our quick and easy contact form below. Briefly tell us about your vision and goals, and we’ll be in touch shortly to discuss a personalized plan for your success.

Al-Khuwair, Muscat, Sultanate of Oman