+968 9596 3381

Phone Number

[email protected]

Email Address

Mon - Thu: 8:00 - 5:00

Online store always open

Phone Number

Email Address

Online store always open

WhatsApp Us Today

Drop Us an Email Today

Google Map Location

Saturday to Thursday

Introduction: Oman’s Rising FDI Profile

Overview of Oman’s FDI Regulatory Environment

Key Drivers of FDI Growth in Oman

Top Sectors Attracting Global Capital in Oman

Renewable Energy & Green Hydrogen

Manufacturing & Industrial Development

Mining & Mineral Processing

Logistics & Supply Chain Infrastructure

Tourism & Hospitality Projects

Fisheries & Agri-Food Industry

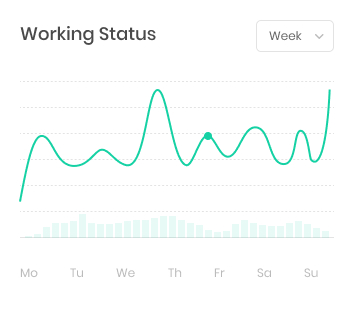

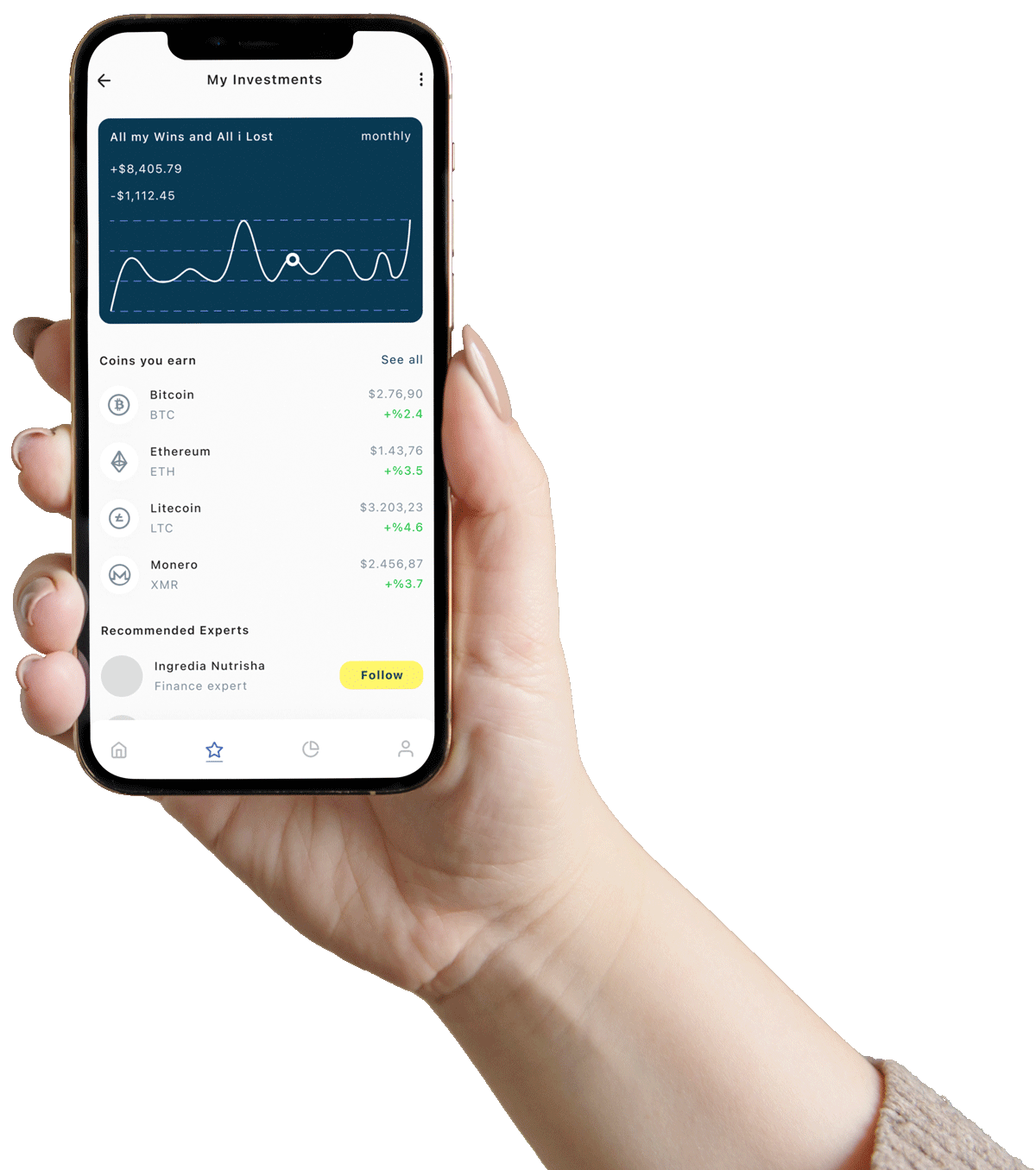

Financial Services & Fintech

Oman Free Zones: Magnet for Foreign Investment

FDI Inflows: Recent Data & Growth Statistics

Government Initiatives Supporting FDI Growth

Challenges Faced by Foreign Investors in Oman

Risk Mitigation Strategies for FDI in Oman

Step-by-Step Process for Foreign Investors in Oman

Case Studies: Successful FDI Projects in Oman

Conclusion: Why Oman is Emerging as GCC’s FDI Hotspot

Oman is rapidly transforming into a preferred destination for Foreign Direct Investment (FDI) in the GCC. Strategic reforms, economic diversification under Vision 2040, and a strong push towards non-oil sectors are driving a surge in FDI inflows to Oman.

Global investors are increasingly viewing Oman as a gateway to the GCC, East Africa, and South Asia markets, leveraging its stable political climate, investor-friendly policies, and world-class logistics infrastructure.

Oman’s Foreign Capital Investment Law (FCIL) has significantly liberalized the investment landscape:

100% foreign ownership allowed in most sectors.

Simplified business registration via the Invest Easy Portal.

Streamlined licensing and sector-specific approvals.

Transparent regulations ensuring legal protection for foreign investors.

Tax incentives and customs duty exemptions in Free Zones.

These reforms have propelled Oman into the radar of multinational corporations, institutional investors, and SMEs seeking regional expansion.

Several factors are accelerating Oman’s FDI appeal:

Economic Diversification: Reduced oil dependency and focus on manufacturing, logistics, tourism, and renewables.

Strategic Location: Access to international shipping lanes connecting Asia, Africa, and Europe.

Infrastructure Readiness: Ports, airports, and industrial estates equipped for large-scale business operations.

Investment-Friendly Policies: Liberal ownership laws, tax holidays, and sectoral incentives.

Free Trade Agreements (FTAs): Bilateral agreements providing tariff advantages.

Youthful, Skilled Workforce: Oman’s focus on human capital development ensures availability of trained professionals.

Oman is positioning itself as a global leader in green hydrogen production. Vast solar and wind resources are attracting energy giants and ESG-focused funds.

Investment Opportunities:

Solar & wind farms.

Green hydrogen production facilities.

Renewable energy infrastructure development.

R&D in clean energy technologies.

Oman’s Free Zones and Industrial Estates are driving FDI into manufacturing sectors such as:

Petrochemicals & Plastics.

Food & Beverage Processing.

Automotive Parts & Components.

Building Materials & Steel Products.

Global manufacturers are setting up export-oriented units (EOUs) to leverage Oman’s logistics advantages.

Rich in copper, limestone, chromite, and gypsum, Oman’s mining sector is undergoing modernization to attract foreign mining corporations and mineral processing ventures.

Investment Areas:

Exploration licenses.

Mineral beneficiation plants.

Export-focused mineral processing units.

Oman’s strategic ports—Duqm, Sohar, Salalah—are magnets for foreign logistics companies, looking to establish regional distribution hubs.

Key Investment Opportunities:

Warehousing & Distribution Centers.

Cold Chain Logistics.

Freight Forwarding Services.

Supply Chain Tech Solutions.

Aligned with Vision 2040, Oman is focusing on eco-tourism, cultural tourism, and luxury hospitality. FDI is flowing into:

Integrated Tourism Complexes (ITCs).

Adventure Tourism Infrastructure.

Heritage Site Redevelopment.

High-end resorts and boutique hotels.

Oman’s extensive coastline and commitment to food security are attracting FDI in:

Aquaculture farms (shrimp, fish hatcheries).

Food processing & packaging plants.

Sustainable farming & agri-tech initiatives.

The Sultanate’s fintech sandbox program is opening doors for:

Digital banking platforms.

Mobile wallet & payment solutions.

Blockchain-driven trade finance platforms.

Insurtech and RegTech startups.

| Free Zone | Core Sectors | Incentives for Investors |

|---|---|---|

| Duqm SEZ | Heavy Industry, Logistics, Tourism, Green Energy | 100% foreign ownership, tax holidays, land leases. |

| Sohar Free Zone | Manufacturing, Logistics, Metal Processing | Proximity to UAE & Saudi markets, duty exemptions. |

| Salalah Free Zone | Agro-Processing, Chemicals, Warehousing | Integrated port access, customs exemptions. |

| Knowledge Oasis Muscat | ICT, Innovation, Digital Startups | Tech ecosystem support, incubator facilities. |

Oman recorded double-digit growth in FDI inflows from 2022-2024.

Key investors include entities from China, India, Saudi Arabia, UAE, and Europe.

Greenfield projects in manufacturing and renewable energy account for the largest share.

Oman’s Free Zones have seen a 20% year-on-year increase in foreign project registrations.

Fintech and digital economy investments witnessed a sharp rise with the launch of regulatory sandboxes.

Invest Easy Portal: Simplified digital platform for business registration.

Oman Vision 2040 Programs: Strategic incentives for diversified sectoral investments.

Public-Private Partnership (PPP) Law: Encouraging foreign participation in infrastructure projects.

In-Country Value (ICV) Programs: Promoting local supplier partnerships while supporting foreign investments.

Fintech Sandbox & Innovation Hubs: Facilitating digital sector FDI through R&D collaborations.

Bureaucratic processes in certain sectoral approvals.

Omanisation workforce localization requirements.

Navigating multi-agency compliance frameworks.

Market competition in matured sectors (e.g., retail, food services).

Regulatory lag in emerging technologies (AI, Blockchain).

Partnering with local corporate service providers to streamline compliance.

Setting up operations within Free Zones for regulatory ease.

Engaging in Joint Ventures to align with Omanisation targets.

Conducting thorough due diligence and feasibility studies.

Leveraging government incentive schemes for CAPEX optimization.

Conduct market research & sector feasibility analysis.

Select Free Zone or Mainland setup based on business needs.

Reserve trade name through MOCIIP or relevant Free Zone.

Prepare and legalize corporate documents.

Obtain Commercial Registration (CR).

Secure sector-specific licenses and approvals.

Open corporate bank accounts.

Register with Oman Chamber of Commerce (OCCI).

Finalize Omanisation workforce strategy.

Launch operations ensuring full regulatory compliance.

Maintain active business operations

Renew business license annually with MOCIIP

Renew residency visa as per the issued duration

Maintain minimum shareholding or capital

Submit audited financials (especially for premium tracks)

Failure to meet ongoing compliance can result in visa revocation.

Launched in 2021 and expanding in 2025, the Golden Visa offers high-net-worth individuals the option to secure 5–10 year residencies based on:

Large-scale business investments

Real estate investments

Job creation for Omanis

Social contributions

It is ideal for investors seeking longer stays, greater flexibility, and enhanced privileges.

Let us handle your company registration, office setup, and licensing to ensure a seamless process.

Oman encourages foreign investment across a wide range of sectors. Choosing the right industry can streamline both business approval and residency visa eligibility.

Top Sectors for Investment-Based Residency in 2025:

Tourism & Hospitality: Establish hotels, desert camps, or travel services aligned with Vision 2040 tourism growth.

Logistics & Transportation: Leverage Oman’s location to operate cargo, warehousing, or port services.

Renewable Energy: Solar and wind energy startups receive strong government backing and incentives.

Technology & IT Services: Ideal for app development, SaaS, e-commerce, and fintech.

Education & Training: Open institutes, tutoring centers, or skill development facilities in partnership with local bodies.

Healthcare & Wellness: Clinics, diagnostics labs, and wellness centers are in growing demand.

Each of these sectors has its own licensing pathway, and many qualify for foreign ownership exemptions.

Residency via business investment is allowed in both mainland Oman and designated free zones, though their benefits differ.

Direct access to local market

Wider sector coverage

Eligible for all visa types

0% corporate tax for a limited period

Full repatriation of profits

100% foreign ownership

Dedicated infrastructure and customs benefits

However, not all free zone businesses qualify for long-term residency, so careful planning is required.

Investor residency visas are typically issued for 2 to 10 years, depending on the investment type and visa class. Here’s how to ensure smooth renewals:

1. Maintain Active Business Operations

Dormant or non-operational companies may lead to rejection.

2. Renew All Business Licenses on Time

Delays in commercial registration (CR) or tax filings can affect visa status.

3. Maintain Minimum Capital & Shareholding

Any drop below the qualifying investment threshold may void your eligibility.

4. Submit Annual Audited Financials

Especially relevant for Golden Visa holders or companies with employees.

Oman allows long-term residency through both real estate ownership and direct business investment.

| Factor | Business Investment | Real Estate Ownership |

|---|---|---|

| Residency Duration | 2–10 years | 5–10 years |

| Eligibility for Employees | Yes (under your company) | No |

| Control Over Operations | Full business ownership | Property only |

| Income Potential | High (profits, contracts) | Rental yield |

👉 For entrepreneurs and job creators, business investment offers more flexibility, while real estate is better for passive investors.

1. Delayed Security Clearance

Solution: Begin documentation early and avoid errors in name/passport submissions.

2. Commercial Activity Restrictions

Solution: Verify sector eligibility with MOCIIP before incorporation.

3. Difficulty Opening Bank Accounts

Solution: Work with local business consultants who can guide you through preferred banking channels.

4. Lack of Office Space

Solution: Consider virtual or co-working options approved by the Ministry.

5. Visa Application Rejection

Solution: Ensure proper translation, attestation, and compliance at each step; consult legal advisors if necessary.

Relocation involves not only the legal process but also adjusting to life in a new country. Here’s what investors should plan:

Housing: Residential properties are widely available in Muscat, Sohar, and Salalah.

Schooling: Reputed international schools (British, Indian, IB) for expat children.

Transport: Private vehicles are common; taxis and limited public transport in major cities.

Healthcare: Access to private hospitals with expat-friendly services.

Lifestyle: Calm, family-oriented environment with low crime and high quality of life.

While Oman has no personal income tax, businesses are subject to certain obligations:

Corporate Tax: 15% flat rate on profits

VAT: 5% applicable on most goods and services

Withholding Tax: 10% on certain cross-border payments

Foreign investors must register with the Oman Tax Authority and file annual returns. Tax compliance directly impacts visa renewals and business continuity.

| Feature | Standard Investor Visa | Golden Visa |

|---|---|---|

| Investment Required | OMR 20,000 – OMR 50,000 | OMR 250,000+ |

| Duration | 2–5 years | 5–10 years |

| Fast Track Processing | No | Yes |

| Real Estate Option | Not applicable | Available |

| Access to Government Deals | Limited | Broader participation possible |

If you’re looking to settle long-term with minimal visa renewals and expanded rights, Golden Visa is your best option.

Once your business is operational, you may hire staff and sponsor employee visas under your company:

Steps to Sponsor Employees:

Register your company with the Ministry of Labour

Apply for a Labour Clearance for each job title

Process visas via the Royal Oman Police

Issue contracts and maintain payroll compliance

Ensure annual labor card and insurance renewal

This is a major benefit of investment-based residency, as it allows entrepreneurs to build and scale their team directly.

Choosing the wrong business structure for your sector

Failing to maintain minimum capital in your corporate account

Attempting to work under a tourist visa while awaiting business formation

Using a PO box as your only registered address

Not translating or notarizing documents as per Omani law

✅ Pro Tip: Work with local specialists to ensure you’re not overlooking any regulatory nuance — especially in sectors like finance, tech, or real estate.

At setupinoman, we specialize in assisting businesses with establishing their presence in Oman. Our services include:

Business Registration & Licensing – Handling all MoCIIP applications and approvals.

Legal Documentation & Compliance – Ensuring smooth document translations and notarization.

Banking & Office Setup – Helping businesses secure bank accounts and office leases.

Visa & Employee Services – Managing work permits and Omanization requirements.

What is the minimum investment required to qualify for a residency visa in Oman?

The minimum investment typically starts from OMR 20,000 for standard investor visas. However, the Golden Visa program requires investments starting from OMR 250,000.

Can I own 100% of my business in Oman as a foreign investor?

Yes, Oman allows 100% foreign ownership in most sectors, especially under the Foreign Capital Investment Law. Some regulated sectors may require local participation.

Is real estate investment enough to obtain a residency visa in Oman?

Yes, under the Golden Visa category, purchasing property worth at least OMR 250,000 can qualify you for long-term residency.

What is the difference between the Golden Visa and the Standard Investor Visa?

Golden Visas offer longer residency terms (5–10 years), faster processing, and broader eligibility, while Standard Investor Visas require lower investment but shorter duration and renewals.

How long does the investor visa process take?

On average, it takes 4 to 8 weeks, depending on security clearance, company registration, and documentation accuracy.

Can I apply for residency before launching my business?

You must complete company registration and capital deposit before applying for the residency visa under the business investor category.

Is it necessary to open a corporate bank account in Oman for this process?

Yes, you need to deposit the minimum share capital into a corporate account to receive the capital deposit certificate, which is essential for visa processing.

Are there any age or nationality restrictions for investor visas?

There are no age restrictions, and citizens from most countries are eligible, although background checks and financial verification are required.

Do I need a physical office in Oman for my business registration?

Yes, a registered office address is mandatory — this can be a virtual office, shared workspace, or physical premises, depending on your business type.

What types of businesses are best for investment-based residency?

Tourism, tech, healthcare, logistics, real estate development, and manufacturing are some of the most attractive sectors for foreign investors.

Is free zone investment also eligible for residency visas?

Yes, businesses established in Oman’s free zones like Duqm or Salalah can qualify, though some limitations apply based on visa type and activity scope.

Can I bring my family with me under an investor visa?

Yes, investor visa holders can sponsor family members including spouse and children, subject to documentation and proof of income.

What are the key documents required for an investor visa application?

Passport copies, security clearance, MOA, business license, capital deposit certificate, tenancy contract, and recent photographs are commonly required.

Do I need to hire local employees?

While not mandatory in all cases, certain sectors may require a minimum Omanization rate to qualify for full operational licensing and staff visa issuance.

What happens if I close my company after receiving the residency visa?

Your visa may be cancelled unless you transfer your sponsorship or obtain a different qualifying residency basis (e.g., real estate or employment).

How long is the investor visa valid?

Standard visas are issued for 2–5 years and renewable; Golden Visas are valid for 5 or 10 years, depending on the investment category.

Can I operate multiple businesses under one investor visa?

Yes, but you must ensure each entity is properly registered, and you hold a qualifying ownership percentage in each.

Are there any tax advantages for foreign investors?

Oman offers no personal income tax and competitive corporate tax rates (15%). Free zones also offer tax holidays for up to 10 years.

Can I change business activities after obtaining a visa?

Yes, but you must update your commercial registration and possibly re-obtain approvals or licenses depending on the new activity.

Is a local sponsor required for mainland businesses?

Not anymore in most sectors. Since the law change in 2020, most businesses can be 100% foreign-owned without requiring a local partner.

How do I maintain my visa status if I spend time abroad?

Investor visas typically allow you to spend time abroad, but extended absence (6+ months) may affect renewal or validity, unless explained.

Are digital or online businesses eligible?

Yes, tech and e-commerce businesses are highly encouraged and eligible for both investor and long-term residency options.

Do I need to show ongoing revenue to maintain the visa?

Not always, but inactivity or lack of compliance may risk rejection during renewal. Annual filings and proof of operation are recommended.

Can I apply for residency through an existing business I acquire?

Yes, provided you meet ownership thresholds and the business is compliant with all legal, tax, and licensing requirements.

What is the role of the Oman Investment Authority in this process?

OIA supports large-scale strategic investments, especially in sectors aligned with Vision 2040. Smaller businesses work mainly with MOCIIP and ROP.

Is the visa tied to one company or can I invest in multiple?

You can invest in multiple companies, but your primary residency visa will be tied to the company where you have majority stake or initial approval.

Do I need health insurance for the investor visa?

Yes, valid health insurance is a prerequisite during visa application and renewal processes.

How much capital is required for the Golden Visa through real estate?

You must invest at least OMR 250,000 in approved properties; for 10-year visas, the amount increases to OMR 500,000 or more.

What is the role of the Royal Oman Police (ROP) in this process?

ROP handles visa issuance, background verification, residency cards, and security clearances.

Can I get citizenship through business investment in Oman?

Currently, Oman does not offer direct citizenship-by-investment programs. However, long-term visa holders may be eligible for permanent residency or naturalization under exceptional circumstances.

Fill out our quick and easy contact form below. Briefly tell us about your vision and goals, and we’ll be in touch shortly to discuss a personalized plan for your success.

Al-Khuwair, Muscat, Sultanate of Oman